LTC Price Prediction: Can Litecoin Overcome Regulatory Hurdles to Reach $200?

#LTC

- Technical indicators show LTC trading below its 20-day MA with mixed momentum signals

- Regulatory uncertainty from SEC ETF delays creates headwinds for price appreciation

- Mining expansion and retail trader activity provide underlying support for gradual recovery

LTC Price Prediction

Technical Analysis: LTC Shows Mixed Signals Near Critical Support

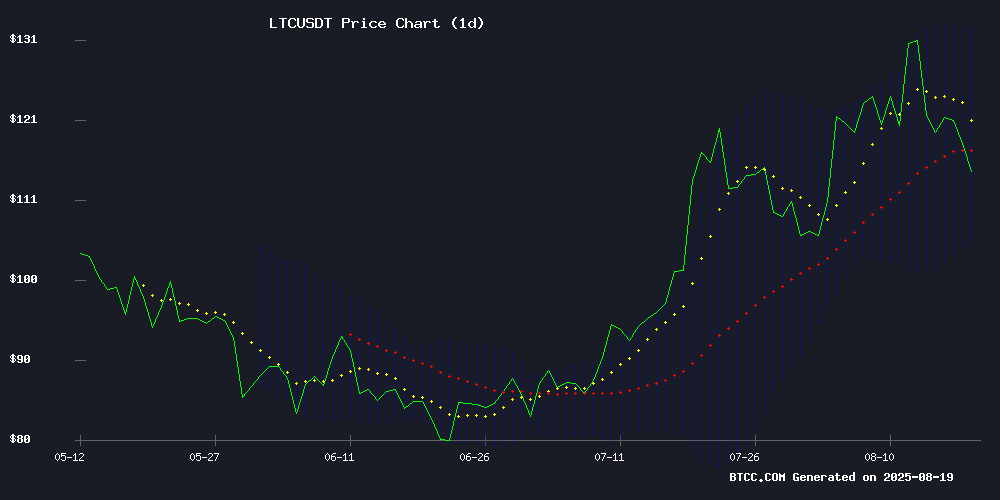

Litecoin currently trades at $114.16, sitting below its 20-day moving average of $118.80, indicating short-term bearish pressure. The MACD reading of -4.4260 remains negative but shows improving momentum with a histogram of 1.2756. Bollinger Bands position LTC between support at $105.08 and resistance at $132.52, suggesting consolidation within this range. According to BTCC financial analyst Mia, 'LTC's ability to hold above the $105 support level will be crucial for any upward movement toward $150.'

Market Sentiment: Regulatory Headwinds Offset Mining Expansion Optimism

Recent news presents a mixed picture for Litecoin. While Thumzup Media's $50 million acquisition of Dogehash Technologies demonstrates growing institutional interest in cryptocurrency mining, regulatory concerns persist. The SEC's delayed decisions on XRP, Litecoin, and Ethereum ETFs reflect ongoing caution. BTCC financial analyst Mia notes, 'The ETF delays create short-term uncertainty, but the mining expansion and retail trader momentum toward $150 suggest underlying strength despite regulatory challenges.'

Factors Influencing LTC's Price

Thumzup Media Expands into Dogecoin Mining with $50M Acquisition of Dogehash Technologies

Thumzup Media Corporation is pivoting from social media marketing to cryptocurrency production through an all-stock acquisition of industrial-scale miner Dogehash Technologies. The deal, valued at 30.7 million shares, follows Thumzup's recent $50 million capital raise—part of which will fund mining rig acquisitions and digital asset accumulation.

Dogehash operates 2,500 Scrypt ASIC miners across North America with a focus on renewable-energy-powered Dogecoin and Litecoin mining. The acquisition positions Thumzup—a Nasdaq-listed company—as a direct participant in proof-of-work cryptocurrency production rather than just a buyer.

The strategic move highlights growing institutional interest in meme coin infrastructure. Dogecoin's fast settlement times and low transaction costs make it particularly attractive for utility-driven applications beyond speculative trading.

SEC Delays Decision on XRP, Litecoin, and Ethereum ETFs Amid Regulatory Caution

The Securities and Exchange Commission has deferred its verdict on proposed ETFs for XRP, Litecoin, and Ethereum until October, dashing hopes for accelerated approvals under new leadership. Even the politically charged Truth Social ETF—backed by Bitcoin and Ethereum—faces the same regulatory limbo despite its institutional support and high-profile branding.

Market participants including 21Shares, Grayscale, and CoinShares remain caught in the crossfire. The delays persist despite the demonstrated success of existing Bitcoin and Ether ETFs, leaving investors increasingly frustrated as the SEC cites procedural requirements for the postponement.

SEC Delays XRP ETF Decision, Extends Review Period for Altcoin Proposals

The U.S. Securities and Exchange Commission has postponed its verdict on spot XRP exchange-traded funds, deferring approvals until at least mid-October. Regulatory hesitation now blankets multiple altcoin ETF applications, including those for Solana and Litecoin.

Issuers like Grayscale and 21Shares face extended scrutiny as the SEC invokes standard 60-day review extensions. Market participants maintain optimism about eventual approvals, with XRP price action showing stability near the $3.00 psychological level during the regulatory limbo.

The pattern of delays mirrors the SEC's cautious approach toward crypto investment products. Observers note the commission appears to be establishing consistent evaluation frameworks before greenlighting altcoin-based financial instruments.

The Landscape of Six Major Cloud Mining Platforms in 2025: How HashedMining Remains the Global Leader

As the cloud mining industry enters a new phase of competition in 2025, investors are prioritizing transparency, flexibility, and sustainability over sheer returns. HashedMining has emerged as a pioneer, leveraging cutting-edge technology and a sustainable operational model to challenge conventional approaches.

The platform's smart contract optimization engine dynamically allocates computing power in real-time, ensuring resources are always directed toward the most profitable cryptocurrencies. This eliminates dependency on any single asset while maximizing returns and enabling active investor participation.

HashedMining supports multi-currency mining, including BTC, LTC, Doge, and XRP, without requiring additional contracts. This diversification strategy enhances asset allocation flexibility and mitigates market risks, providing steady returns even during periods of volatility.

All mining operations are powered by 100% renewable energy, significantly reducing costs while meeting ESG investment benchmarks. This commitment to sustainability ensures long-term energy efficiency and positions HashedMining as an industry leader in responsible crypto mining practices.

Litecoin Holds Trendline Support as Retail Traders Fuel Momentum Toward $150

Litecoin's fifth consecutive bounce off its long-standing trendline support underscores persistent buyer interest at key levels. The altcoin's resilience, despite muted whale activity, suggests a foundation for upward movement—with $150 emerging as a plausible target.

Retail traders dominate current accumulation, with on-chain data revealing consistent sub-$1 million orders. This grassroots participation contrasts with quieter institutional players, yet mirrors historical patterns where retail momentum precedes broader rallies.

Crypto Market Retreats Amid Regulatory Crackdown and Cautious Futures Sentiment

Bitcoin futures sentiment has cooled sharply to 36%, far below the neutral threshold, as traders brace for Fed Chair Jerome Powell's upcoming speech. The cryptocurrency now trades near $115,000 after briefly touching $123,000 last week, with technical indicators suggesting short-term bearish pressure. Market analysts note that sustained sentiment below 45-50% could invite further downside toward $112,000.

South Korea's Financial Services Commission has escalated its regulatory stance, ordering immediate suspension of all crypto lending services across domestic exchanges. The move affects 13% of borrowers already facing liquidation, with the FSC warning of inspections for non-compliant platforms. This regulatory intervention creates fresh headwinds for market liquidity during a period of already fragile sentiment.

Will LTC Price Hit 200?

Based on current technical indicators and market sentiment, reaching $200 in the near term appears challenging but not impossible. LTC would need to overcome several resistance levels and benefit from improved regulatory clarity. The current technical setup shows LTC trading 43% below the $200 target, requiring approximately 75% upside movement.

| Target Price | Current Price | Required Gain | Key Resistance |

|---|---|---|---|

| $200 | $114.16 | 75.2% | $132.52, $150 |

BTCC financial analyst Mia suggests, 'While $200 remains a possibility in a strong bull market scenario, investors should focus on the $150 resistance level first, which aligns with current retail trader momentum and would represent a more immediate realistic target.'